By Erin Johnson, JCJ Insurance Agency

Whether your firm owns vehicles or not, chances are you have employees who use their personal vehicles for business purposes. Most design firms are aware that they need proper coverage for automobiles they own but are less clear about potential liabilities for vehicles they do not own – such as employee vehicles or rental cars.

When partners, employees, or interns use their personal vehicles to visit job sites, run errands or conduct company business, your firm faces “non-owned” auto exposure. The firm does not own the vehicle, but it is being used on behalf of the business. Likewise, if an employee rents a vehicle while on a business trip, your firm faces “hired” auto exposure. Hired coverage is for situations in which autos are not owned by the company or the driver. In the event of an accident in either of these situations, your firm could be subject to a costly claim.

Generally, your employee’s personal auto policy provides the primary insurance, even if the personal vehicle or rental car is used for business. However, if the damages and liability claims exceed the employee’s policy limits, then the injured party will look to your firm’s “deep pockets”. That’s where Hired and Non-owned Auto Liability insurance can help.

HIRED AND NON-OWNED AUTO INSURANCE

To protect your business and reduce significant risks to your company’s assets, we recommend that every firm purchase Hired and Non-owned Auto Liability insurance. Most of your clients’ contracts require that your firm has Auto Liability coverage. Even if it is not a contractual requirement, this is an important (and relatively inexpensive) coverage that all firms should carry.

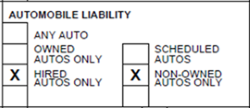

If your firm has company-owned vehicles, you probably already have a commercial automobile policy in place that includes this coverage. To verify, check your current Certificate of Insurance. There are three different situations in which this coverage can be shown. In the Auto Liability section (1) Any Auto can be checked, or either (2) Owned Autos or (3) Scheduled Autos, along with Hired Autos and Non-owned Autos can be checked.

If your company does not own any vehicles, Hired and Non-owned coverage can be purchased in conjunction with your General Liability policy. In this situation, the only boxes that should be checked are the Hired Autos and Non-owned Autos.

It is important to note that Hired and Non-owned coverage provides liability protection to the firm only, it does not cover the car nor the driver.

If Hired Auto coverage provides liability protection to the firm when renting cars, do you still need to purchase the additional insurance offered by the rental agency? Great question!

INSURANCE TIPS FOR RENTAL VEHICLES

When traveling on business and renting a car you are given a choice to purchase or reject insurance offered by the rental car company. The most common of these coverages include Loss Damage Waiver and Supplemental Liability Insurance. The following defines the coverage options and offers recommendations of which coverage your firm may need.

Loss Damage Waiver (LDW)

What is it?

LDW, also known as Collision Damage Waiver, is not insurance. It is an agreement where the car rental company gives up its right to collect any damages from you if a vehicle is damaged or stolen. If coverage is rejected and a loss occurs you are financially responsible, even if you are not at fault. Not only are you responsible for repair or replacements costs, but this financial obligation also includes:

- Loss of Use – the earnings lost by the rental company when the car is being fixed and is not available for rent

- Diminution in Value – loss of resale value when a vehicle is involved in an accident

- Administrative Fees – including, but not limited to, towing, impound, and storage

Should I buy it?

The Loss Damage Waiver is the coverage that people should examine most closely. While Business Auto Policies, Personal Auto Policies, and credit card companies may offer some coverage, there may be gaps for some of the indirect expenses you might face – such as Diminution of Value and Loss of Use. If your firm does not rent cars on a regular basis, spending an additional $25-$40 a day to buy the LDW is probably wise. If you are involved in an accident and have purchased the LDW, the claim will be handled directly with the rental car company and your insurance company will not be involved. You turn in the keys and go.

If your firm regularly rents vehicles for business travel, you can add Hired Auto Physical Damage coverage to your existing Auto policy. However, this will not cover Diminution of Value or Loss of Use. We recommend working with one car rental company. Working exclusively with one rental company will allow to modify terms and negotiate pricing. Working with one company also makes it easier for your employees to have a clear understanding of the coverages provided through the firm’s insurance and what coverages they need to select when renting a car.

Supplemental Liability Insurance (SLI)

What is it?

SLI provides third party liability coverage if you are at fault in an auto accident.

Should I buy it?

If your firm has Hired & Non-owned Auto coverage, you do not need to purchase Supplemental Liability Insurance. If not, then this additional cost should be added to the rental agreement.

OTHER CONSIDERATIONS

Company Auto Policy

We recommend that you implement a company policy regarding automobile use, procedures for renting vehicles, and what to do when involved in an accident. An effective company policy identifies who can drive on behalf of the business, defines authorized travel, and the company’s position on transporting others. It should provide guidelines on what is required of employees who have permission to drive such as a valid driver’s license, insurance, and an acceptable Motor Vehicle Report (MVR). It should also include your firm’s policy for renting vehicles. The Rental Car Policy should include your firm’s preferred rental car company and corporate account number, if applicable, as well as procedures for purchasing or rejecting the Loss Damage Waiver and other insurance coverages offered by the rental agency.

International Travel

Your firm’s Auto policy provides coverage for the United States, its territories and possessions, Puerto Rico, and Canada. If you travel and rent vehicles internationally, talk with your insurance agent about the unique risks and coverage options available for international car rentals.

IN CLOSING

We would like to discuss for a moment the “Any Auto” option on the Certificate of Insurance. “Any Auto” is the broadest form of Auto Insurance. It provides coverage for vehicles that are owned by the firm and scheduled with the insurance company, any vehicles that you own that you may have forgotten to schedule, as well as Hired and Non-owned autos. Recently, we have seen more requests from your clients asking to have the “Any Auto” box checked as a contractual requirement. By law, we are not allowed to check that box unless you actually have that coverage. If your firm does not own any autos, we have had success in providing the Hired and Non-owned Auto Certificate of Insurance along with a letter from your firm stating that the firm does not own any vehicles.

Navigating the exposures and contractual requirements of Business Auto insurance can be daunting. Your time should be spent on designing creative and safe spaces for your community. If you do not already have these insurance coverages and guidelines in place, we recommend discussing your needs with an insurance professional who has experience working with design firms and is familiar with professional service contracts. Auto liability claims can be very expensive, especially if injuries are involved. Any type of exposure for your firm, no matter how small, is too big to ignore.